GR/IR clearing account (goods receipt/invoice receipt clearing account)

What is a GR/IR clearing account (goods receipt/invoice receipt clearing account)?

A GR/IR clearing account (goods receipt/invoice receipt clearing account) is a bookkeeping device that can be used when goods arrive before the invoice is generated or when an invoice arrives before the goods are delivered.

Every time a company buys goods or services, the same set of activities are carried out every time and in the same order:

- Company places the order or requisition for the goods or services.

- Company receives the ordered goods or services.

- Provider sends the invoice to the company.

- Company makes the payment against the invoice.

Sometimes, the provider may deliver the goods or services before generating the invoice. At other times, it may generate and send the invoice before delivering the goods or services. In either case, the purchasing transactions must be valued at actual cost. But, to do so, it's necessary to match and, if required, revalue the transactions entered at different times. That's where the GR/IR clearing account comes in.

After the company records the goods received and/or associated invoices in their accounting system, there is a need to clear the accounts for purchases in transit and unbilled payables. To do so, a GR/IR clearing account is used.

How a GR/IR clearing account is used

In the normal course of business, discrepancies often exist between goods received and quantity invoiced for a purchase order (PO). These differences produce an artificial debit or credit balance.

The GR/IR clearing account checks the quantity of goods received against the quantity of goods invoiced and then posts a positive or negative balance accordingly. The GR/IR clearing account thereby serves as a buffer between the inventory account and the vendor account, minimizing confusion and reducing the risk of accounting errors.

Thus, regardless of whether the goods are received before the invoice or the invoice is generated and entered before the goods are received, the GR/IR account enables companies to determine the differences between the values of goods receipts and goods invoices and value each purchasing transaction at actual cost.

What is invoice clearing in SAP?

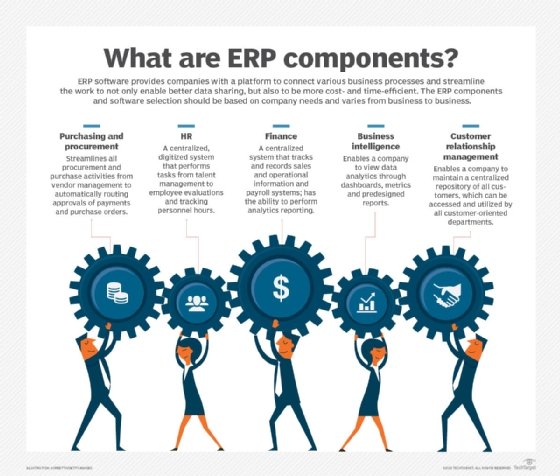

SAP is a type of enterprise resource planning (ERP) software with modules and features for multiple business areas, including procurement, production, finance, sales, marketing and human resources. Despite its seemingly disparate business functions, SAP ERP provides a single source of truth that enables companies to streamline and manage these functions, improve operational efficiency and enhance day-to-day workflows.

GR/IR Clearing is a function in the SAP ERP platform that facilitates invoice clearing. Specifically, the function can be used to clear two accounts:

- Purchases in transit refers to invoiced but not yet received goods or services.

- Unbilled payables refers to goods received but not yet invoiced.

Clearing these two accounts with the GR/IR function in SAP ERP enables accounts teams to determine the differences between the values of the goods receipts and their associated invoices.

GR/IR function in SAP explained

With SAP ERP, the GR/IR function is executed as a run in the Inventory Accounting work center, part of SAP Materials Management. The account is a clearing account for goods and services purchased either via a PO, priority PO or, in some cases, contract release. It is a vendor-agnostic liability account.

When the goods are received, the expense account in SAP is debited (charged), and the GR/IR account is credited. But, when an invoice is entered, the GR/IR account is debited, and the provider's/vendor's payables account (liability account) is credited. When the quantities on the receipt and the invoice match, the GR/IR account is cleared. The mechanism enables the information on the PO, receipt and invoice to be matched.

Example of invoice clearing in SAP ERP and GR/IR

Whenever a user enters the receipt of the goods or service or a supplier invoice in SAP ERP, several account movements take place. The following examples demonstrate these movements:

- Example 1: Supplier S delivers 100 pieces of Product P to Company C

- The total value of 100 P is $1,000; the price per unit of P is $10.

- When S delivers 100 P, SAP ERP posts the goods receipt to the relevant asset account.

- C's inventory or expense account is debited with the provisional value of the delivery. This value is calculated as: PO price x quantity delivered = $1,000.

- The unbilled payables (GR/IR clearing account) is credited with the same value ($,1000).

- Example 2: Supplier S delivers an invoice for 100 pieces of Product P to Company C

- The total value of 100 P is $1,000, and the price per unit of P is $10.

- When S sends the invoice, it gets posted to the payables account in SAP, and the supplier account is credited with the invoice value.

- At the same time, the purchases in transit (GR/IR clearing account) is debited with the same invoice value ($1,000).

On starting the clearing run, the user can understand the differences between the value of the goods receipt and the valued invoice. During the clearing run, the purchases in transit and unbilled payables accounts are cleared.

Prerequisites to maintain consistent accounting with SAP ERP and GR/IR

To ensure a consistent accounting process for similar business transactions, accounting teams and SAP ERP users must satisfy several requirements:

- During procurement, all POs must be entered in the supplier relationship management resource, and third-party POs must be entered in the supply chain management system.

- All transactions must be matched up by entering all PO-related transactions -- receipt of goods/services and receipt of invoices -- that result in postings on the GR/IR clearing accounts.

- The goods receipt must have a nonzero value.

- For each PO item, the checkboxes related to Goods and Services Receipt Expected, Invoice Expected and Evaluated Receipt Settlement must all be selected.

Satisfying all these prerequisites ensures that the two clearing accounts are posted whenever the organization receives either goods or an invoice. More importantly, it helps ensure a consistent, error-free accounting process.

Learn about enterprise accounting software and its benefits. Explore the seven advantages of ERP in accounting and how to choose the right accounting software, from SMB to enterprise.