lean manufacturing (lean production)

Lean manufacturing is a methodology that focuses on minimizing waste within manufacturing systems while simultaneously maximizing productivity. Waste is seen as anything that customers do not believe adds value and are not willing to pay for. Some of the benefits of lean manufacturing can include reduced lead times, reduced operating costs and improved product quality.

Lean manufacturing, also known as lean production, or lean, is a practice that organizations from numerous fields can enable. Some well-known companies that use lean include Toyota, Intel, John Deere and Nike. The approach is based on the Toyota Production System and is still used by that company, as well as myriad others. Companies that use enterprise resource planning (ERP) can also benefit from using a lean production system.

Lean manufacturing is based on a number of specific principles, such as Kaizen, or continuous improvement.

Lean manufacturing was introduced to the Western world via the 1990 publication of The Machine That Changed the World, which was based on an MIT study into the future of the automobile detailed by Toyota's lean production system. Since that time, lean principles have profoundly influenced manufacturing concepts throughout the world, as well as industries outside of manufacturing, including healthcare, software development and service industries.

5 principles of lean manufacturing

A widely referenced book, Lean Thinking: Banish Waste and Create Wealth in Your Corporation, which was published in 1996, laid out five principles of lean, which many in the field reference as core principles. They are value, the value stream, flow, pull and perfection. These are now used as the basis for lean implementation.

1. Identify value from the customer's perspective. Value is created by the producer, but it is defined by the customer. Companies need to understand the value the customer places on their products and services, which, in turn, can help them determine how much money the customer is willing to pay.

The company must strive to eliminate waste and cost from its business processes so that the customer's optimal price can be achieved -- at the highest profit to the company.

2. Map the value stream. This principle involves recording and analyzing the flow of information or materials required to produce a specific product or service with the intent of identifying waste and methods of improvement. Value stream mapping encompasses the product's entire lifecycle, from raw materials through to disposal.

Companies must examine each stage of the cycle for waste. Anything that does not add value must be eliminated. Lean thinking recommends supply chain alignment as part of this effort.

3. Create flow. Eliminate functional barriers and identify ways to improve lead time. This aids in ensuring the processes are smooth from the time an order is received through to delivery. Flow is critical to the elimination of waste. Lean manufacturing relies on preventing interruptions in the production process and enabling a harmonized and integrated set of processes in which activities move in a constant stream.

4. Establish a pull system. This means you only start new work when there is demand for it. Lean manufacturing uses a pull system instead of a push system.

Push systems are used in manufacturing resource planning (MRP) systems. With a push system, inventory needs are determined in advance, and the product is manufactured to meet that forecast. However, forecasts are typically inaccurate, which can result in swings between too much inventory and not enough, as well as subsequent disrupted schedules and poor customer service.

In contrast to MRP, lean manufacturing is based on a pull system in which nothing is bought or made until there is demand. Pull relies on flexibility and communication.

5. Pursue perfection with continual process improvement, or Kaizen. Lean manufacturing rests on the concept of continually striving for perfection, which entails targeting the root causes of quality issues and ferreting out and eliminating waste across the value stream.

The 8 wastes of lean production

The Toyota Production System laid out seven wastes, or processes and resources, that don't add value for the customer. These seven wastes are:

- unnecessary transportation;

- excess inventory;

- unnecessary motion of people, equipment or machinery;

- waiting, whether it is people waiting or idle equipment;

- over-production of a product;

- over-processing or putting more time into a product than a customer needs, such as designs that require high-tech machinery for unnecessary features; and

- defects, which require effort and cost for corrections.

Although not originally included in the Toyota Production System, many lean practitioners point to an eighth waste: waste of unused talent and ingenuity.

7 lean manufacturing tools and concepts

Lean manufacturing requires a relentless pursuit of reducing anything that does not add value to a product, meaning waste. This makes continuous improvement, which lies at the heart of lean manufacturing, a must.

Other important concepts and processes lean relies on include:

- Heijunka: production leveling or smoothing that seeks to produce a continuous flow of production, releasing work to the plant at the required rate and avoiding interruptions.

- 5S: A set of practices for organizing workspaces to create efficient, effective and safe areas for workers and which prevent wasted effort and time. 5S emphasizes organization and cleanliness.

- Kanban: a signal used to streamline processes and create just-in-time delivery. Signals can either be physical, such as a tag or empty bin, or electronically sent through a system.

- Jidoka: A method that defines an outline for detecting an abnormality, stopping work until it can be corrected, solving the problem, then investigating the root cause.

- Andon: A visual aid, such as a flashing light, that alerts workers to a problem.

- Poka-yoke: A mechanism that safeguards against human error, such as an indicator light that turns on if a necessary step was missed, a sign given when a bolt was tightened the correct number of times or a system that blocks a next step until all the previous steps are completed.

- Cycle time: How long it takes to produce a part or complete a process.

Lean vs. Six Sigma

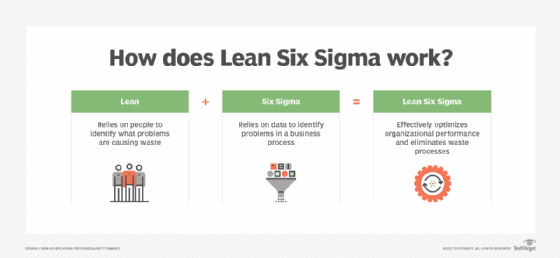

Six Sigma is an approach to data-driven management, similar in nature to lean, which seeks to improve quality by measuring how many defects there are in a process and eliminating them until there are as little defects as possible.

Both lean and Six Sigma seek to eliminate waste. However, the two use different approaches since they address the root cause of waste differently.

In the simplest terms, where lean holds that waste is caused by additional steps, processes and features that a customer doesn't believe adds value and won't pay for, Six Sigma holds that waste results from process variation. Still, the two approaches are complementary and have been combined into a data-driven approach, called Lean Six Sigma.