ERP finance module

What is the ERP finance module?

The ERP finance module is the software component that handles the main accounting and financial management functions of an enterprise resource planning system. It contains standard accounting records, such as the general ledger (GL) and balance sheet; generates financial reports; and handles related transactions, such as invoicing and expense reporting. The ERP finance module, which is sometimes referred to as core finance, also commonly supports other financial management functions such as profitability analysis and revenue management.

ERP is modular software designed to integrate an organization's business processes into a single system running on a central database. The finance module shares data with other core business functions, including inventory management, production planning, purchasing and customer relationship management. When a transaction in one of these other modules has a financial impact or must be recorded in the accounting system, it usually triggers an action or transfer of data in the ERP finance module.

Why are ERP finance modules important?

The finance module is usually the first component activated in an ERP system and the reason organizations replace their standalone accounting software with ERP. Integrating the finances of the various business functions helps ensure accounting accuracy, which is essential in meeting financial regulations and reporting requirements that have grown more stringent in recent years. It also provides the consolidated financial data needed to measure and improve corporate performance.

The finance module is also the component that most differentiates ERP software from other integrated business applications, such as human capital management (HCM) and supply chain management suites, and from ERP's predecessor, material requirements planning, which mostly addresses the raw materials and components needed in manufacturing. It is the one truly essential ERP module and often serves as the vanguard of deployment when a company changes ERP systems or expands to new locations.

This article is part of

The ultimate guide to ERP

ERP finance module features

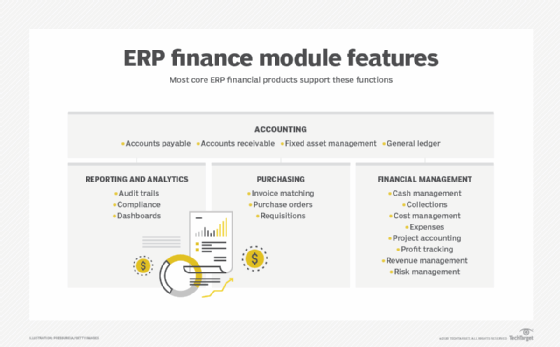

Following are the main features of an ERP finance module:

- General ledger. The GL is a comprehensive record of a company's financial transactions. It tracks income and expenses, capital, assets and liabilities in a set of numbered accounts, such as accounts payable and receivable, cash and inventory. Totals in the general ledger feed into key reports produced in the finance module, notably the balance sheet, which records assets and liabilities, and the income statement, which shows revenues and expenses.

- Accounts payable (AP). An organization uses the AP function to manage the money it owes vendors and other creditors. By automating AP, an enterprise can save time and money, as well as minimize human error. AP also integrates an organization's payables data with its purchasing system, which may be part of core finance or in a separate purchasing or procurement module, enabling better control of cash flows.

- Accounts receivable (AR). The AR function is where a company manages the money that customers owe. It tracks payments and manages cash and invoices. An organization can use this function to automate such tasks as generating recurring invoices, financial statements and payment reminders. By automating the AR process, a company can accelerate collections and make it easier for customers to pay, thereby improving cash flow and customer satisfaction.

- Fixed asset management. Companies use this feature to track and manage tangible assets, such as computers, factory equipment and vehicles. Fixed asset management lets an organization take into consideration depreciation calculations, compliance requirements and tax implications. By using this feature, it can get better visibility into how it uses its fixed assets, along with their associated costs and maintenance.

- Purchasing. Most ERP finance modules have features a company can use for basic purchasing of supplies and services, including generating the required paperwork, such as requisitions and purchase orders. Integration with AP usually provides the necessary handling of invoices, while invoice matching ensures that vendor invoices match the information in AP before payment is processed. Organizations that need more sophisticated purchasing capabilities, especially for buying the raw materials and components needed for manufacturing, usually have a more sophisticated procurement module from the ERP vendor or a third-party provider.

- Risk management. The finance module's enterprise risk management features enable an organization to predict, analyze and manage risks to its operations and financial stability. For example, getting a handle on credit risk can ensure that a company has enough cash reserves on hand to cover AP if a customer misses a payment. Risk management features can also help companies deal with issues related to security, legal liabilities, compliance and reputational risks.

- Reporting. Basic reporting features provide access to financial data, often in real time, and help a company to prepare financial reports typically for internal use, though some products can produce reports and audit trails needed for regulatory requirements. The reporting features' visibility into ERP financial data helps an organization make data-driven decisions and predictions about its finances. Business intelligence and analytics features give a company a clearer view of its revenue picture. Dashboards can display actual and expected sales, expenses and other financial information.

- Profit tracking. The profit tracker provides a picture of the overall financial health of a business and how it is using its financial resources. With profit tracking -- sometimes called profitability analysis -- an organization has visibility into where its profits come from. Some profit trackers will also forecast the return on investment from different sales channels based on historical sales and expense data.

- Tax management. This feature, available in some finance modules, stores the ERP system's tax settings and provides tax reporting and audit functions. It enables an organization to collect tax information from all of its financial documents into a single repository. It also generates the reports a company needs to file its taxes.

Benefits of ERP

The ERP finance module helps speed up an enterprise's financial processes and offers auditable revenue management and expense management. It also enables clearer communication of financial information to external parties, including vendors, customers and governments.

Other benefits include the following:

- Financial transparency. Analytics dashboards, reports and GLs give authorized users the information they need to understand their company's financials.

- Improved productivity. When a company automates time-consuming financial processes, productivity usually improves.

- Fewer human errors. Accounting errors, including data entry mistakes, are easier to detect and avoid.

- Better-informed planning and budgeting. The ERP finance module's analytics and reporting functions help a company to forecast costs and revenue and produce more accurate budgets.

- Tracking and organizing financial documents. The digital format means an organization is less likely to lose documents because they're usually filed in the right place automatically.

- No missed payments. The AP feature notifies a company about upcoming payments, which can be sent out automatically.

- Centralization. Employees can access financial information in one place.

- Integration. Because the ERP finance module is integrated with other ERP modules and business systems, finance managers have access to key data, such as sales figures and marketing budgets.

ERP finance module use cases

A business use case is a common task or workflow carried out using software. Here are some examples from ERP finance:

- Payables. Invoice processing, cash management and bank reconciliation.

- Receivables. Billing, extending credit and matching invoices with cash received.

- Revenue recognition. Recording revenue that is received over time rather than in a single transaction. Strict regulations require such revenue to be recognized properly in the general ledger and income statement.

- Reconciliation. Automatically reconciling account discrepancies to avoid delays in the monthly close.

- Collections. Analyzing receivables and customer accounts to identify payment risks and taking steps to encourage timely collection.

ERP finance module vendors

The ERP market consists of several dozen vendors offering a range of systems geared to companies of varying sizes, from SMBs to large enterprises.

Infor, Microsoft, Oracle and SAP are the four biggest ERP vendors by global revenue, according to most market research firms, and have broad product lines that start with entry-level ERP for small businesses.

Deployment options range from on-premises systems to cloud-based ERP that runs on the vendor's servers -- or those of a partner -- and is delivered over the internet to users.

One type of cloud, SaaS, is increasingly used as a way to move just the ERP finance module to the cloud while keeping other parts of ERP on premises. This hybrid approach is often the first step in a plan to eventually move all of ERP to the cloud.

With SaaS, multiple customers usually share a single copy of the software, which lowers costs and helps enforce standardization and good business practices. Acumatica, Certinia (formerly FinancialForce), Oracle NetSuite and Workday are vendors that specialize in SaaS ERP.

Other prominent ERP brands include DELMIAworks, Epicor, IFS, Kenandy, Plex, QAD, Sage Intacct and Syspro.