general ledger (GL)

What is a general ledger (GL)?

A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. Each account is a unique record summarizing a specific type of asset, liability, equity, revenue or expense. A chart of accounts lists all of the accounts in the general ledger. A large business can have thousands of accounts in its GL.

Certified public accountants (CPAs) and bookkeepers typically are the ones accessing and using general ledgers. Following the accounting equation, any debit added to a GL account will have a corresponding and equal credit entry in another account, and vice versa.

Companies use general ledgers to for the following reasons:

- monitor finances;

- track transactions and cash flow;

- compile and maintain information for business-related reports; and

- help prevent accounting errors and fraud.

Why do companies use general ledger accounts?

A general ledger provides value to businesses in several ways, including the following three:

- Financial statements. GLs generate a number of important financial statements for various internal stakeholders. They can use the financial information provided in those statements when making business decisions.

- Accounting records. A GL also provides financial accounting records for all of an organization's business transactions and account balances. These records and the financial data they contain can help accountants spot unusual, erroneous or fraudulent transactions.

- Trial balance. A GL enables a business to compile a trial balance where all debits and credits are totaled. Most organizations do this periodically, often at the end of a reporting period, so they can proactively stay on top of expenses.

How does a general ledger work?

The general ledger functions as a collective summary of transactions posted to subsidiary ledger accounts, such as cash, accounts payable, accounts receivable and inventory.

General ledgers work using a double-entry accounting method. This approach shows expenses and income items in dollar amounts as debits and credits. Each general ledger item or entry can be divided into four main parts:

- a journal entry describing the item number of the transaction posted to the account;

- a description for the specific transaction;

- a debit or credit value for the net balance change; and

- a resulting balance after the credit or debit is posted.

During the bookkeeping process, other records outside the general ledger, called journals or daybooks, are used for the daily recording of transactions. The general journal consists of the accounting entries for each business transaction that occurred in order by date.

These transactions can include cash payments against an invoice and their totals, which are posted in corresponding accounts in the general ledger. In accounting software, the transactions will instead typically be recorded in subledgers or modules.

The totals calculated in the general ledger are then entered into other key financial reports, notably the balance sheet -- sometimes called the statement of financial position. The balance sheet records assets and liabilities, as well as the income statement, which shows revenues and expenses.

Income statements are considered temporary accounts and are closed at the end of the accounting year. Their net balances, positive or negative, are added to the equity portion of the balance sheet.

For example, the equity portion might include the shareholders' or owners' equity in a private company, retained earnings in a nonprofit organization and figures that are derived by subtracting liabilities from tangible and intangible assets. In contrast, the accounts that feed into the balance sheet are permanent accounts used to track the ongoing financial health of the business.

General ledger accounts are not budget accounts. Instead, they show actual amounts spent or received and not merely projected in a budget.

A company may opt to store its general ledger using blockchain technology, which can prevent fraudulent accounting transactions and preserve the ledger's data integrity.

Types of general ledger accounts

Broadly, the general ledger contains accounts that correspond to the income statement and balance sheet for which they are destined.

The income statement might include totals from general ledger accounts for cash, inventory and accounts receivable, which is money owed to the business. They are sometimes broken down into departments such as sales and service, and related expenses. The expense side of the income statement might be based on GL accounts for interest expenses and advertising expenses.

Other GL accounts summarize transactions for asset categories, such as physical plants and equipment, and liabilities, such as Accounts payable, notes or loans.

Other types of GL accounts

While the above accounts appear in every general ledger, other accounts may be used to track special categories, perform useful calculations and summarize groups of accounts. The latter type is called a control account.

For example, a CPA might use a T-account -- named because of its physical layout in the shape of a T -- to track just the debits and credits in a particular general ledger account.

General ledgers and double-entry bookkeeping

Following the rules of double-entry bookkeeping, each entry in the general ledger must appear in two places: once as a debit and once as a corresponding credit. And the two added together must equal zero.

In accounting, the terms debit and credit differ from their commonplace meanings. Whether each adds to or subtracts from an account's total depends on the type of account. For example, debiting an income account causes it to increase, while the same action on an expense account results in a decrease. Goods-receipt/invoice-receipt accounts can have either a credit or debit balance.

General ledger reconciliation

At the end of each fiscal period, a trial balance is calculated by listing all of the debit and credit accounts and their totals. Those with debit balances are separated from the ones with credit balances. The debit and credit accounts are then totaled to verify that the two are equal. If they aren't, the accountant looks for errors in the accounts and journals.

However, the trial balance does not serve as proof that the other records are free of errors. For example, if journal entries for a debit and its corresponding credit were never recorded, the totals in the trial balance would still match and not suggest an error.

Companies use a general ledger reconciliation process to find and correct such errors in the accounting records. In some areas of accounting and finance, blockchain technology is used in the reconciliation process to make it faster and cheaper.

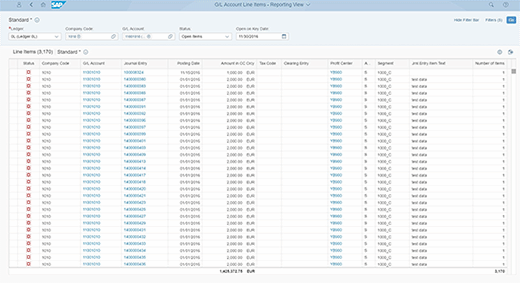

General ledger accounting software

For centuries, general ledgers were kept on paper. However, in recent decades they have been automated using enterprise accounting software and in enterprise resource planning applications. These tools integrate core accounting functions with modules for managing related business processes.

Some of the business processes managed could include the following:

- order management

- human resource management

- enterprise asset management

- risk management and compliance

- supply chain management

- customer relationship management

- business intelligence

- financial reporting

In such systems, the GL serves as a central repository for the accounting data. Features that general ledger software should have include the following:

- bank reconciliation

- tax preparation

- customizations

- reporting and dashboards

- mobile applications

General ledger transaction example

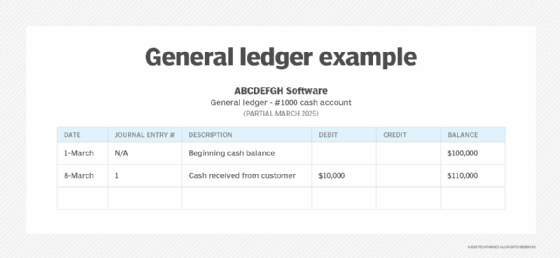

Here is an example of an accounting system transaction within a general ledger for a fictional account, ABCDEFGH Software. Note that this example refers to ABCDEFGH Software's cash account.

The leftmost column in the example above is the date of the transaction. To its right is the journal entry number associated with the transaction, which contains an identifying number associated with the transaction.

The description of the transaction is in the next column. It states the reason behind the transaction. In this example, the transaction is for a cash payment from a client account to ABCDEFGH Software. Since the cash account is receiving income, then the debit column will show an increase and display a sum for the amount. In this case, it is $10,000.

For this transaction, the credit column will remain unchanged for this account. However, a separate ledger for the company's accounts receivable will reflect a credit reduction for the same amount, because ABCDEFGH Software no longer has that amount receivable from its client.

To maintain the accounting equation's net-zero difference, one asset account must increase while another decreases by the same amount. The new balance for the cash account, after the net change from the transaction, will then be reflected in the balance category.

A general ledger is an important, fundamental accounting tool. GLs and accounting can be improved using blockchain technology. Learn about ways other industries are using blockchain technology.