cloud ERP

What is cloud ERP?

Cloud ERP is a type of enterprise resource planning software that runs on a provider's cloud computing platform, rather than on premises on an enterprise's own computers.

ERP is a modular software system designed to integrate an organization's business processes, such as accounting, HR, inventory management and purchasing, into a unified system. Before the popularization of modern cloud computing in the late 1990s, ERP systems ran inside the owner's facility, or "on premises." The cloud ERP era began in 1998 with the debut of the first ERP system to be delivered over the internet, NetLedger, later renamed NetSuite.

Components of cloud ERP software

Both on-premises and cloud ERP systems have a centralized database for storing information about business transactions so it can be easily accessed and shared among modules. Having one version of a purchase order, for example, helps ensure consistency of the information across modules and departments, minimizes errors and facilitates reporting.

The only module that is common to all ERP systems, regardless of deployment model, is the one for basic accounting and finance functions, as well as related processes such as financial management, analytics, forecasting and reporting. Most ERP products also have modules for human capital management (HCM) and customer relationship management (CRM). In both on-premises and cloud ERP systems, modules for procurement and order management are also used widely, since those functions are common to all types of industries and businesses regardless of whether their product is a tangible or intangible good or a service.

This article is part of

The ultimate guide to ERP

Companies that make or distribute physical goods need additional ERP modules, typically for inventory management and supply chain management, a broad function that includes complex processes for distribution, warehousing, transportation and logistics, as well as planning functions, such as demand management and forecasting. Manufacturers also typically use a material requirements planning module to plan, schedule and procure the raw materials and components needed for production.

Beyond these common business functions, ERP modules tend to be more specialized and narrowly focused depending on the particular industry or type of company and business requirements. For example, companies with large amounts of capital equipment will usually have a module for enterprise (or fixed) asset management. A manufacturer might use a product lifecycle management module to manage all the data and planning processes for a product, from conception to design, engineering, production, distribution and disposal. An organization with an urgent need to dig deeper into its financial and operational health might add enterprise performance management. A consultancy might need a sophisticated project management module.

While some ERP systems handle all these functions in a single integrated suite, it's common for organizations to add "best of breed" modules from other vendors who specialize in that function and whose products integrate with the main ERP. They often do this because they find the ERP module too limited for their needs. Human resources is often the first to be added. Companies with rapidly rising sales or a need to address customer satisfaction will often buy a separate CRM system to improve customer service.

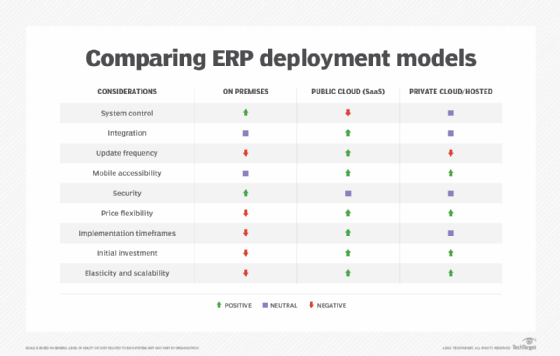

On-premises ERP vs. cloud ERP

The breadth and depth of available modules can differ significantly between on-premises and cloud ERP products.

In the early years of cloud ERP software, cloud versions usually had far fewer modules than their on-premises predecessors. The gap has narrowed as ERP vendors have shifted most of their development effort away from on-premises versions to the cloud, and today many cloud ERP systems include the broad range of functional modules that are available on premises. However, vendors still struggle to deliver comparable features in their cloud ERP offerings, which have only recently begun outselling on-premises ERP.

One increasingly popular type of cloud ERP, multi-tenant software as a service, or SaaS ERP, is typically a streamlined version with fewer modules and features than the same vendor's on-premises ERP. In multi-tenant SaaS, multiple "tenants" use the same copy, or instance, of the software. This scheme tends to enforce standardization and simplification, since the same software must serve customers with varying needs. It is the biggest reason SaaS ERP tends to have fewer modules than on-premises ERP.

There are other important differences. SaaS ERP can't be customized, for the most part, which is a serious drawback for companies that spent years customizing on-premises ERP to meet their unique needs. (SaaS proponents claim this is a plus because it helps enforce industry best practices, reduces IT costs and makes the ERP system less prone to bugs and crashes.) On-premises ERP usually has high upfront costs, including a large payment for a multiyear license, while SaaS typically comes as a monthly, per-user subscription, though vendors increasingly offer pricing that combines the two models. SaaS ERP requires less investment in IT staff and infrastructure.

Despite these differences, debates continue about which deployment model is cheaper for ERP buyers in the long run. The total cost of SaaS ERP can exceed that of on-premises ERP after seven to 10 years, and vendors have said SaaS is cheaper for them to maintain and has more growth potential from subscription revenue. Most are trying to wean customers off their aging on-premises ERPs but face resistance as companies question whether cloud ERP does what they need and is worth the money.

Security and reliability issues likewise cut both ways and can't be resolved without delving into specific products and technologies. Cloud ERP, because it's accessed remotely over the internet, may seem more vulnerable to public network outages, and some companies might be uncomfortable trusting software maintenance to an outsider. On the other hand, internal networks are also susceptible to outages, and companies may lack the expertise to keep the software running as well as a cloud ERP vendor can. As for security, early fears about the safety of sensitive ERP data stored in the cloud have subsided as companies have come to realize their own data centers may be less secure than those of cloud providers.

Few companies have to choose between the two and can opt instead for a combination called hybrid ERP. A typical setup retains on-premises ERP -- perhaps a system that is highly customized and closely integrated with other on-premises systems for manufacturing and warehouse management -- and adds specialized SaaS ERP modules for HCM or CRM.

This tendency to mix and match not just ERP products and deployment models but vendors has led to a paradigm shift in how ERP is defined. Business applications are now often pieced together rather than acquired in a single, "monolithic" ERP suite. Such "postmodern ERP" provides flexibility but adds significant integration challenges.

Types of cloud ERP software

Cloud ERP vendors sometimes apply the cloud label to software that has few of the unique qualities of the cloud, especially multi-tenant SaaS' economies of scale and fast, frequent updates that carry the latest technology. Some deployment models simply shift the location of the underlying IT infrastructure without changing the program code of the on-premises ERP software. A third-party provider "hosts" the ERP in its data center and the customer accesses the software over the internet.

Calling such hosted ERP "cloud" may at times be misleading, but such services appeal to customers who remain cautious about entirely new SaaS ERP products but want some of the benefits of cloud infrastructure.

Buyers therefore need to ask cloud ERP providers for details about their cloud platforms. There are three major types. Here's how they affect ERP choices:

- Multi-tenant SaaS ERP runs on the purest form of cloud and is usually the simplest, with the fewest modules and little to no customizability. It is often the easiest to deploy and least expensive.

- Single-tenant SaaS ERP allows each customer to have its own slice of the ERP software running on the cloud provider's platform. The customer still gets the flexible compute power and subscription pricing of cloud, but the data and ERP system are cordoned off from those of other customers. It usually costs more than multi-tenant SaaS because there are no economies of scale from sharing the application. Some companies choose single-tenant SaaS for their own privacy and security reasons or the legal requirements of countries where they do business.

- Private cloud ERP is a single instance of the SaaS ERP software that runs on cloud infrastructure hosted by the ERP vendor or a third-party provider. Though the underlying infrastructure isn't typically shared like in single-tenant SaaS, private cloud still provides some key benefits of cloud, including subscription pricing and the ability to scale resources depending on the need. In some cases, the ERP owner has some control over the IT decisions instead of delegating all of them to the cloud service provider. A private ERP cloud can even run entirely on premises in an organization that has its own cloud infrastructure. However, this is stretching the meaning of cloud, which historically has been defined as on-demand delivery over the internet from an external provider.

Both types of SaaS ERP are usually hosted on a public cloud, which is cloud computing infrastructure and services from a provider other than the ERP vendor itself. Since the late 2010s, most cloud ERP vendors have outsourced their cloud platform responsibilities to public cloud providers such as Amazon Web Services, Google Cloud and Microsoft Azure.

In practice, the thick black lines between public and private cloud have all but disappeared, and most cloud ERP offerings exist on a continuum that combines features of both. In addition, multi-tenancy can be fine-tuned as vendors and their cloud-provider partners add it to lower layers of the cloud "stack." For example, customers choosing either single-tenant SaaS or private cloud can get multi-tenancy benefits at the database, operating system or hardware levels, while running the ERP application in a single tenant at the top layer.

Benefits of cloud ERP software

Cloud ERP can be easier and cheaper to maintain than on-premises ERP, since the cloud ERP provider handles maintenance of hardware and software. Cloud-based ERP software also comes with availability, backup and disaster recovery guarantees that reduce interruptions to the software. It can also have a lower total cost of ownership, especially if per-user subscription costs stay under on-premises license fees as the user base grows.

The cheap, easy connectivity of the internet makes it much easier to extend the ERP system to outside suppliers, partners and customers. This enables a whole new level of collaboration in critical processes like sales forecasting, supply chain management and talent acquisition.

Why cloud ERP is important in the enterprise

Like other cloud-based service models, cloud ERP lets enterprises pay only for the resources used while providing the flexibility to add or subtract cloud resources as needs fluctuate.

The cloud also allows delivery of new technologies such as AI faster than on-premises ERP in updates that usually occur every quarter. Cloud ERP vendors have been the most adept at improving the ERP user experience. It is easier to deliver a modern user interface with new UX technologies, such as tiled GUIs, voice user interfaces and smartphone access from SaaS than from on-premises ERP, where update cycles are measured in years.

Enterprises are increasingly turning to cloud ERP to replace their aging, on-premises ERP systems, simplify maintenance, improve usability and reduce costs. Many also find it essential to their digital transformation strategies, which often call for new e-commerce, CRM and HCM capabilities best delivered over the cloud.

Challenges with cloud ERP

Cloud ERP provides many benefits, but it also creates some management challenges. Administrators lose significant control when the software moves off site. On-premises ERP is much more customizable, though limited customization of cloud ERP is possible by changing the software configuration and settings and adding extensions. Cloud ERP, especially SaaS, often requires substantial training and change management to get employees accustomed to new workflows and business processes.

Companies also need to adapt to the cloud ERP provider's security, which may differ substantially from that of on-premises ERP. They must pay special attention to different countries' data residency requirements and follow local privacy and security regulations if their ERP data resides in multiple data centers.

Cloud subscription costs can begin to exceed on-premises licensing costs after several years and at companies that grow rapidly, making cloud ERP more expensive overall. The financial risk requires ERP buyers to educate themselves about the most common SaaS ERP subscription models and carefully scrutinize each vendor's plans, which can be quite complicated.

Cloud ERP vendors

The Gartner research firm reported that the global ERP software market for both on-premises and cloud ERP reached $44 billion in revenue in 2023. In analyst market-share reports, SAP typically tops the list of vendors, followed by Oracle, Microsoft, Infor, Workday and Sage. With the exception of Workday, the market leaders have a long history that started with on-premises ERP (now often referred to as "legacy" ERP) and since the early 2000s have introduced numerous cloud ERP offerings.

Smaller but equally long-standing vendors with a similar mix of deployment models include Acumatica, Deltek, Epicor, IFS, IQMS, QAD, Ramco and Unit4.

Besides Workday, prominent SaaS-only (or "pure play") cloud vendors include Certinia (formerly FinancialForce), Oracle NetSuite, Plex, Rootstock Software and Sage Intacct.

Gartner doesn't publicize a breakout of cloud ERP revenue or vendor shares, but in a 2023 report on global public cloud revenue, it predicted spending on all SaaS applications would increase sharply from $174 billion in 2022 to $244 billion in 2024.